Nano Dimension completes $179.3M acquisition of Desktop Metal, aiming to enhance its industrial 3D printing solutions amid legal and leadership challenges.

The Desktop Metal acquisition has been completed by Israeli industrial 3D printing leader Nano Dimension for a total consideration of 179.3million(5.295 per share), marking a critical advancement towards consolidating its holdings in cutting-edge tech. This merger comes after months of regulatory complications and legal battles which resulted in the formation of a single corporate entity expected to surpass an annual revenue run rate of $200 million by the end of 2024.

Deal Dynamics and Strategic Vision

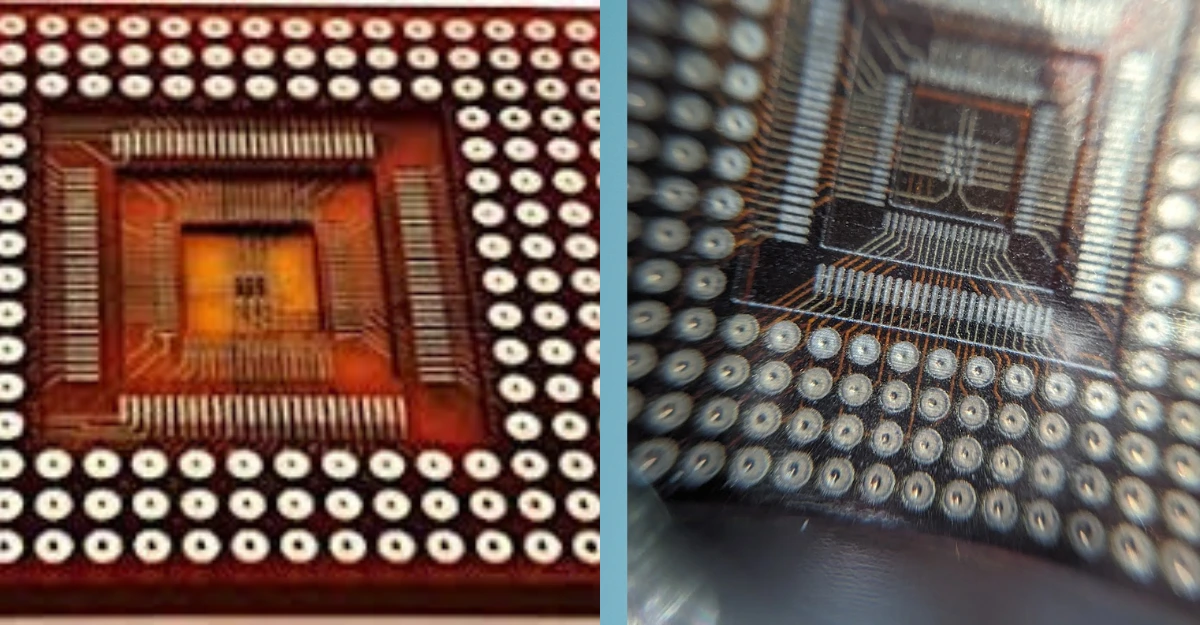

Originally announced at $183 million ($5.50 per share), the final valuation reflects adjustments tied to regulatory approvals and closing conditions. The merger unites Nano Dimension’s expertise in electronics-focused additive manufacturing with Desktop Metal’s strength in mechanical and medical 3D printing systems. The combined portfolio now spans capital equipment, materials, and software tailored for industries including aerospace, automotive, consumer electronics, and healthcare.

“This acquisition captures a critical strategic opportunity for us to provide leading edge solutions to our customers worldwide,” states Chairman of Nano Dimension Ofir Baharav. He underlined plans to consolidate execution, capture cost synergies, focus on promising product lines, and high impact areas in operations.

Legal Battles and Leadership Overhaul

The completion of the deal comes after an embroiled legal battle. In December 2023, Desktop Metal sued Nano Dimension in Delaware’s Court of Chancery claiming that Nano Dimension did not obtain the necessary regulatory approvals in a timely manner. This was rebutted by Nano Dimension categorically stating, “We dismiss the claims as completely without merit.” Another suit charged Nano Dimension with agreement violations for attempting to acquire competitor Markforged for $115 million, an action that Desktop Metal claimed would compromise their merger.

A court ruling mandated the deal’s closure by March 31, 2025, though Desktop Metal retained rights to extend the deadline indefinitely. The acquisition ultimately proceeded under a restructured leadership team installed in December 2024 after activist shareholder Murchinson Ltd. ousted former CEO Yoav Stern and several board members. Murchinson had criticized Stern’s M&A strategy, labeling the Desktop Metal and Markforged deals as “overpriced” and “misguided.”

To address shareholder concerns, Baharav restated the commitment to “disciplined capital management” along with operational efficiency.

Integration and Growth Strategy

Nano Dimension has outlined a four-pillar strategy to maximize the merger’s value:

- Maintaining Financial Strength: Ensuring a robust capital base to support innovation.

- Driving Profitable Growth: Targeting high-revenue technologies and markets.

- Increasing Margins: Improving the efficiency of supply chains and manufacturing processes.

- Developing Customer Relationships: Deepening relations with government agencies and Fortune 500 companies.

The integration activities started with the merging of R&D, sales, and supply chain functions following the acquisition. Moreover, the company reiterated its plans to go forward with the Markforged merger to expand its market coverage.

Market Impact and Future Outlook

The merger puts Nano Dimension at the top of the list as a singular, fully integrated provider of all industrial 3D printing solutions for industries that are precision and complexity driven, including defense and medical technology. Analysts have noted the combined company’s capability to transform stagnant paradigms, especially in rapid prototyping and low-volume manufacturing.

But difficulties still exist. Nano Dimension has to contend with integration risks, the overhang of activist investors, and outstanding lawsuits. The firm intends to provide further comprehensive updates regarding financial and operational performance after completing a strategic review.

Customer desktops featuring Print 3D include the aerospace behemoth Lockheed Martin, automotive titan Ford, and Medtronic in the medical devices sector. These firms are poised to take advantage of Technological Capabilities TM. Concurrently, shareholders of Nano Dimension are waiting for the reported cost synergies to shine through, which are said to reach more than $50 million per year.

Read more : Scientists Develop 3D Printable Foam for Underwater Vehicles

Industry Reactions

Participants in the industry have shared moderately positive sentiments. “Consolidation in the 3D printing space is inevitable,” said a senior analyst at Gartner. “Nano Dimension’s aggressive M&A strategy could make it a leader, but they risk overextending their resources.”

All eyes are now on Nano Dimension’s next moves as the company’s dual focus on innovation and efficiency seeks to redefine industrial manufacturing—one layer at a time.